The Rivers State Government appears to be moving forward with the implementation of the Federal High Court’s order in Port Harcourt authorizing the state government to introduce Value Added Tax.

This is despite an Appeal Court ruling in Abuja on Friday instructing all parties in the case to maintain the status quo awaiting the outcome of the current litigation.

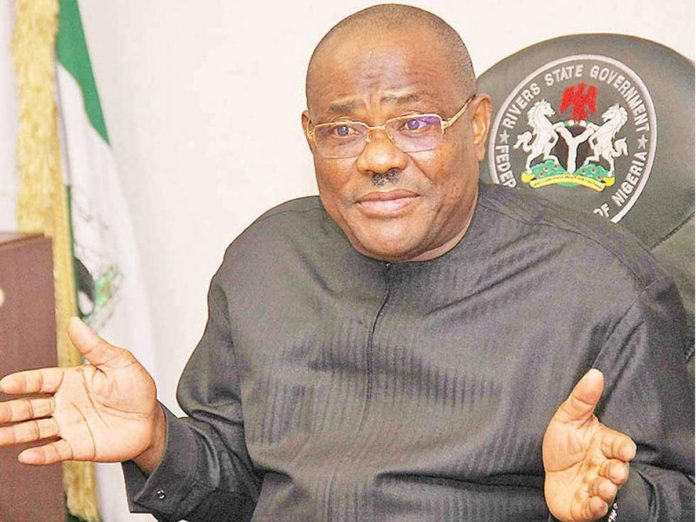

On Friday, however, Rivers State Governor Nyesom Wike launched a four-man tax appeal commission with a mandate to deal with “complaints emanating from people who refuse to pay their taxes, as well as those who believe the tax body is doing something it is not supposed to do.”

Gov. Wike has directed that the Rivers State Value Added Tax bill be implemented by 2021.

The Governor, speaking at the Rivers State Government House in Port Harcourt, asked the members of the committee to instill a new culture in which taxable persons and companies follow the state’s tax laws without hesitation.

Read Also: Arewa leaders have been given a wake-up call – Wike receives support from Ganduje’s former aide on the VAT issue

Bennett, Justice Eke Ugbari (rtd) was named as the commission’s chairman, while Edwin Krukrubo, Owhonda Ihekwoaba Nobel, and Mrs. Gift Sovins were named as commissioners.

Taxes, according to the Governor, are crucial sources of revenue for any government in order to meet its financial needs in order to carry out its development plan.

“It is a very serious assignment at this time in terms of what is going on,” he says. As a result, I feel you must accept this job as a call to duty from your state.

“Without taxes, no country can exist. As a result, you will do everything possible to assist the government and citizens in carrying out their responsibilities.

“I believe in you, Chairman, that you will be able to lead the commission members to do the right thing.”

Justice Bennett Eke Ugbari (rtd), the commission’s chairman, remarked after the inauguration that Rivers State has to create enough internal revenue to supplement the statutory allocations it receives from the federal government.

Read Also: FG work with South Africa to promote peaceful coexistence

“As a result, the commission intends to collaborate with other relevant tax agencies in Rivers State in order to produce appropriate internal income for the state,” he stated.

He pledged that the panel will carry out its responsibilities in accordance with the principles of fairness, justice, and equity.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now