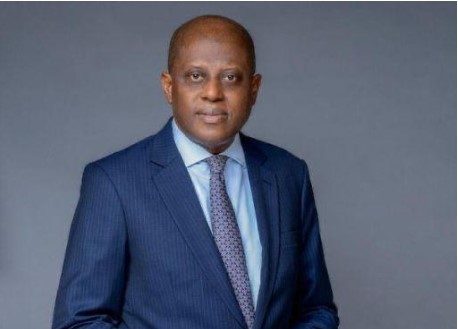

The governor of the Central Bank of Nigeria, Dr. Olayemi Cardoso, has said there was pushback from players in the oil & gas industry when the apex bank issued a new directive on the use of foreign exchange proceeds by firms in the sector.

Cardoso revealed this on Thursday at the BusinessDay CEO forum themed ‘Leadership in Tough Economic Times’ held in Lagos.

Asked for an update on the impact of the directive, the CBN governor said, “It is still work in process. To be frank, when this first came out, we got some pushback. But, we dialogued, spoke, looked at the issues that some of the players were uncomfortable with, and gave reassurances which seemed to calm many of them down and it works in process.

“I see that it is gradually getting to a phase where the sort of contributions that one would expect from that sector would be there.”

In a circular dated May 6, 2024, signed by the Director, Trade and Exchange Department, Hassan Mahmud, the apex bank said oil firms can now spend 50 per cent of the repatriated export proceeds on financial obligations.

The CBN said, “Following the recent inquiries by banks and other stakeholders on our circular referenced TED/FEM/PUB/FPC/001/004, in respect of Cash Pooling requests by banks on behalf of IOCs, we provide further clarifications as follows:

“The initial 50 per cent of the repatriated proceeds can be pooled immediately or as when required. Banks may submit the request for cash pooling ahead of the expected date of receipt, supported by the required documentation, for approval by the Central Bank of Nigeria.

“The 50% balance of the repatriated export proceeds could be used to settle financial obligations in Nigeria, whenever required, during the prescribed 90-day period.”

The CBN said petroleum profit tax, royalty, domestic contractor invoices, cash calls, domestic loan principal and interest payment, transaction taxes, education tax, and forex sales at the Nigerian Foreign Exchange Market are eligible for settlement from the balance 50 per cent.

The CBN earlier stopped international oil companies operating in Nigeria from immediately remitting 100 per cent of their forex proceeds to their parent companies abroad.

The regulator said that the practice known as ‘cash pooling’ had an impact on liquidity in the domestic forex market.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now