Asian markets were mixed Tuesday as investors struggled to extend a surge on Wall Street, where the tech sector bounced back after last week’s losses, while attention turned to the upcoming release of key US inflation data.

In New York, all three main indexes rose, with the S&P 500 and Nasdaq up more than one per cent each.

Asia followed suit Tuesday morning but some markets were unable to maintain their advances.

Tokyo finished flat and there were losses in Hong Kong, Shanghai, Mumbai, Bangkok and Jakarta, while Sydney, Seoul, Singapore, Wellington, Manila and Taipei rose.

London and Paris fell at the open while Frankfurt rose.

Joe Biden’s decision to drop out of the presidential election race and endorse Vice President Kamala Harris had little major impact on sentiment, analysts said, though there is much debate about who she chooses as her running mate.

However, analysts warned the road will likely be bumpy over the next few months.

Saira Malik at Nuveen said Biden’s decision to pull out of the presidential race “adds even more uncertainty around what has already been a tumultuous 2024 geopolitical landscape.

“Mr Biden announced he will endorse… Kamala Harris, but the exact path forward is uncertain.

“If this news gives former President Trump a bump in the polls, that could provide a further boost to areas of the market that have been pricing in increased prospects for a Republican sweep in November.

“One thing does seem certain: More twists and turns in the political roller coaster in the months ahead.”

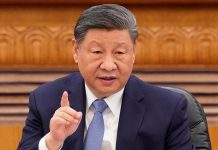

Traders are also hoping for more policy announcements to kickstart the stuttering Chinese economy after last week’s closely watched Third Plenum of leaders unveiled few measures save a pledge to help local governments financially.

This week has seen a more upbeat start after a sell-off last week that came on the back of a tech retreat fuelled by profit-taking and reports the White House was planning a fresh crackdown on firms supplying chip tech to China.

But, optimism for another healthy earnings season, particularly among semiconductor makers, saw a bounce on Monday, with market darling Nvidia among the big winners along with Broadcom and Texas Instruments.

This week sees releases by Google parent Alphabet, Tesla and Spotify.

Tech firms have led the rally in markets this year, helping push all three main indexes in New York to multiple record highs, thanks to expectations the Federal Reserve will cut borrowing costs.

After last week was devoted to the US election and the assassination attempt on Donald Trump, the central bank’s monetary policy is back in focus ahead of Friday’s report on personal consumption expenditure, the Fed’s favoured gauge of inflation.

The figure has come down steadily in recent months, giving central bank officials room to begin cutting rates, with bets on a September move increasing.

In currency markets, the dollar weakened against the yen ahead of a policy meeting at the Bank of Japan next week that some say could see it hike interest rates again.

The greenback has softened of late against the Japanese unit, with OANDA’s Kelvin Wong citing two catalysts.

“Firstly, it has been the increased odds of a more dovish US Federal Reserve… to kickstart in the September (policy) meeting after a slew of soft key US economic data in terms of spending and inflationary trends.

“Secondly, in an earlier Bloomberg interview with… Donald Trump published on Tuesday, 16 July, Trump implied that he favoured a weaker US dollar against the Japanese yen and Chinese yuan yuan (due to US exports losing competitiveness).”

Seoul-listed Kakao tanked more than five percent on news that the billionaire founder of the internet conglomerate, Kim Beom-su, had been arrested Tuesday facing accusations of manipulating stock prices during the purchase of K-pop powerhouse SM Entertainment.

– Key figures around 0715 GMT –

Tokyo – Nikkei 225: FLAT at 39,594.39 (close)

Hong Kong – Hang Seng Index: DOWN 0.9 per cent at 17,476.49

Shanghai – Composite: DOWN 1.7 per cent at 2,915.37 (close)

London – FTSE 100: DOWN 0.3 per cent at 8,172.10

Euro/dollar: DOWN at $1.0884 from $1.0890 on Monday

Pound/dollar: DOWN at $1.2919 from $1.2929

Dollar/yen: DOWN at 156.54 yen from 157.08 yen

Euro/pound: UP at 84.25 pence at 84.20 pence

West Texas Intermediate: FLAT at $78.38 per barrel

Brent North Sea Crude: UP 0.1 per cent at $82.47 per barrel

New York – Dow: UP 0.3 per cent at 40,415.44 (close)

AFP

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now