The Senate has praised the Central Bank of Nigeria (CBN) for what it called positive changes in the country’s monetary and financial system during the first half of 2025.

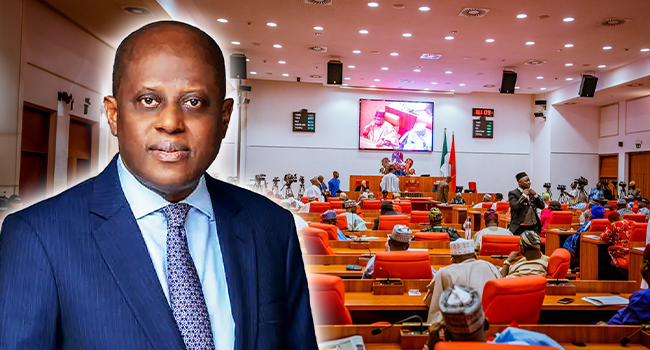

The praise was made before the National Assembly at a statutory meeting between the Senate Committee on Banking, Insurance, and Other Financial Institutions and Mr. Yemi Cardoso, the governor of the CBN.

In his opening statement, committee chairman Adetokunbo Abiru praised the apex bank for the consistent improvement in macroeconomic indices, which he claimed indicated greater stability and trust in the Nigerian economy.

Abiru said, “The Nigerian financial and monetary landscape has seen encouraging developments since our last meeting in December 2024.”

He pointed to the slow accretion of foreign reserves, the relative stability of the exchange rate, especially the closing gap between the official and parallel market rates, and the decrease of inflation from 23.71% in April 2025 to 22.97% in May.

Read Also: Coalition: Anywhere Peter Obi goes, I follow – Isaac Fayose

“These results show increased trust in the foreign exchange market, which is bolstered by the Bank’s reform initiatives like the FX Matching System and FX Code, which aim to increase market discipline and transparency,” he stated.

The committee also commended the CBN’s Monetary Policy Committee (MPC) for keeping the MPR at 27.50% during its February and May meetings. Senator Abiru characterized this as “a deliberate pause to the rate hikes witnessed in 2024, signalling a more balanced approach in managing inflation and supporting growth.”

Additionally, the Senate recognized the apex bank’s approach to recapitalization, namely the regulatory forbearance offered to Deposit Money Banks, which it described as having “pragmatic flexibility.”

Abiru stated, “This policy reflects a pragmatic approach by the Bank to ease transitional burdens on financial institutions, even though it was carefully crafted to avoid systemic risk.”

The committee also emphasized the renewal of Nigeria and China’s bilateral currency swap agreement, which permits local currency settlements for trade. According to Abiru, the action would support the CBN’s overarching goal of diversifying Nigeria’s external reserves and lessen the country’s dependency on the US currency.

Furthermore, the committee applauded the CBN’s implementation of the Non-Resident Bank Verification Number (NRBVN) framework, claiming that it will enhance Know-Your-Customer (KYC) procedures for Nigerians and foreign account holders.

In an increasingly globalized economy, “this initiative is critical for ensuring financial system integrity and expanding the reach of formal banking services,” Abiru said.

Even though there had been progress, he noted that there were still certain areas that needed work, which would be discussed in the executive session with the governor of the CBN.

In his presentation, Mr. Cardoso listed several policy initiatives and accomplishments that he oversaw, emphasizing how they contributed to long-term prosperity and macroeconomic stabilization.

He pointed out that a lot of the bank’s recent moves were strategically in line with the federal government’s objective of having a $1 trillion economy by 2030.

The governor of the CBN stated, “The Bank started a forward-looking recapitalization of the banking sector as a potent catalyst for driving this vision to support the vision for the $1 trillion GDP by 2030.”

In order to increase investor confidence and economic resilience, Cardoso reaffirmed the bank’s dedication to institutional reforms, policy discipline, and strategic alliances.

The Senate voiced satisfaction with the CBN’s reform trajectory throughout the engagement, which was a rare instance of the legislative and the central bank aligning. However, the Senate also emphasized the necessity for ongoing oversight and progress.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now