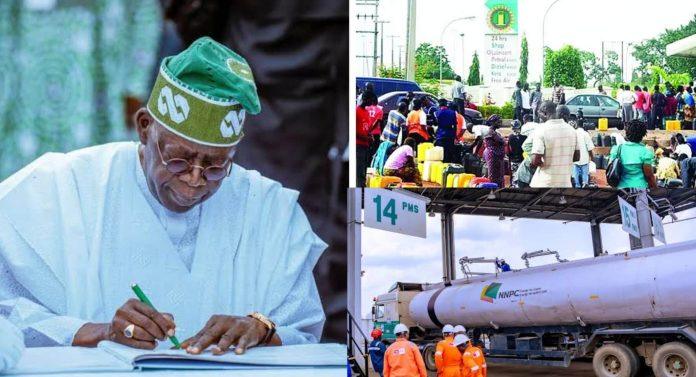

A 15% ad-valorem import charge on gasoline and diesel imports entering Nigeria has been approved by President Bola Tinubu.

Although the program is intended to stabilize the downstream market and safeguard regional refineries, pump prices will probably increase as a result.

Tinubu instructed the Federal Inland Revenue Service and the Nigerian Midstream and Downstream Petroleum Regulatory Authority to implement the tariff immediately as part of what the government referred to as a “market-responsive import tariff framework” in a letter dated October 21, 2025, which was made public on October 30, 2025.

The letter, which our correspondent got on Wednesday and was signed by his private secretary, Damilotun Aderemi, expressed the President’s acceptance of a suggestion made by Zacch Adedeji, the Executive Chairman of the FIRS.

In order to bring import costs into line with domestic market realities, the proposal called for the imposition of a 15% tariff on the cost, insurance, and freight value of imported gasoline and diesel.

In his message to the President, Adedeji clarified that the action was a component of ongoing reforms to support local refining, maintain price stability, and fortify the naira-based oil economy in accordance with the administration’s Renewed Hope Agenda for fiscal sustainability and energy security.

“Operationalizing crude transactions in local currency, strengthening local refining capacity, and ensuring a stable, affordable supply of petroleum products across Nigeria are the core objectives of this initiative,” Adedeji said.

Additionally, the head of FIRS cautioned that market volatility has resulted from the current mismatch between locally refined products and import parity price.

He stated, “Price instability persists, partly due to the misalignment between local refiners and marketers, even though domestic petrol refining has begun to increase and diesel sufficiency has been achieved.”

He pointed out that the standard for setting pump prices, import parity pricing, frequently falls short of local manufacturers’ cost recovery levels, especially during freight and foreign exchange fluctuations, placing pressure on newly established domestic refineries.

According to Adedeji, the government’s role is now “twofold, to ensure a level playing field for refiners to recover costs and attract investments, while protecting consumers and domestic producers from unfair pricing practices and collusion.”

He said that the new tariff structure will promote a fair and competitive downstream environment and deter duty-free gasoline imports from undermining domestic manufacturers.

The 15% import tariff could raise the landing cost of gasoline by an estimated N99.72 per liter, according to estimates in the letter.

This is an increase of about 99.72 per litre at current CIF levels, which pushes imported landed costs in the direction of local cost-recovery without restricting supply or raising consumer prices over acceptable limits. The predicted Lagos pump costs would still be substantially lower than regional averages like Senegal ($1.76 per litre), Cote d’Ivoire ($1.52 per litre), and Ghana ($1.37 per litre) even after this modification, remaining in the range of N964.72 per litre ($0.62).

The strategy is implemented as Nigeria steps up attempts to increase domestic refining and lessen reliance on imported petroleum products.

While modular refineries in the states of Edo, Rivers, and Imo have begun small-scale petrol refining, the 650,000 barrels-per-day Dangote Refinery in Lagos has started producing diesel and aviation fuel.

But even with these improvements, up to 67% of the country’s petrol needs are still met by imports.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now