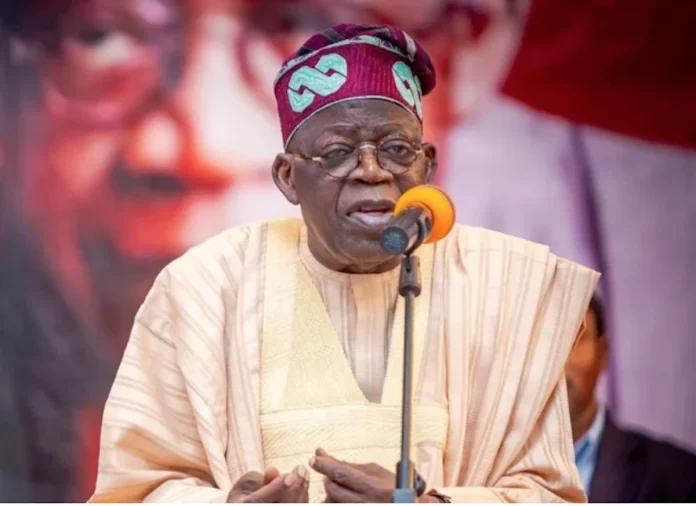

The President Bola Tinubu-led administration wants to leverage the agenda outlined by Wale Edun, Minister of Finance and Coordinating Minister of the Economy, to change the difficult economic situation.

When he presented Tinubu’s ambitions, goals, and economic plan at his first news conference on Friday in Abuja, he made this statement.

Mr. Edun claimed that the administration has identified a number of key areas, including food security, economic development, utilising human resources by emphasising inclusivity, women, and young people, as well as rule of law and anti-corruption.

ad

He stated that in order for Nigerians to see the accomplishments of the various Ministers, there would be regular performance evaluations.

In order to provide Nigerians a better economy and a better quality of life, Mr. Edun stated: “This is to give you aspects of Tinubu’s vision and his strategy for the economy.

“His objectives for the economy include economic growth, the creation of jobs, and access to finance, especially consumer credit that makes growth affordable for the typical Nigerian.

His top aims for Nigeria are to enhance the lives of its citizens by ensuring their food security and putting a stop to poverty.

According to the minister, the last time the nation saw significant economic growth, low inflation, a stable currency, and cheap interest rates was ten years ago.

We all understand that we are not where we ought to be; the economy is expanding just slightly faster than the rate of population growth, but this was not always the case.

According to Edun, the nation had enough foreign currency to protect the naira and satisfy its financial obligations during the administration of former President Goodluck Jonathan.

It “indicates that we have a situation where the government needs to assist and allow private finance and other sources of funding such as foreign direct investments and domestic investments by Nigerians in all areas if it doesn’t have the money,” he said.

In order for the government to have adequate cash to cover its expenses, Mr. Edun claimed that Tinubu’s strategy included boosting revenues.

“On the one hand is through increasing tax revenue, not by raising taxes, but by bringing about higher efficiency and to maximise the revenue.

“good debt management and efficiency in government spending will be prioritised so that borrowing is connected to good debt management.

The president would also “offer a better life for everybody by encouraging investments that boost productivity, grow the economy, and consequently create jobs and eliminate poverty,” the speaker added.

The chairman of the Presidential Fiscal Policy and Tax Reforms Committee hinted to intentions to reform the country’s tax system and reduce N20 trillion in yearly losses due to tax avoidance, evasion, and incentives.

According to him, tax incentives used by previous administrations that did not result in the expected benefits for the nation cause Nigeria to lose up to N6 trillion annually.

“If you don’t examine your incentive system, it may reach a point where it distorts economic growth because it favours some people over others who work in the same industry, making it impossible for them to compete.

“If you look at our tax expenditure statistics, over the last three to four years, we have paid out on average about N6 trillion year; this is considerable, but what we haven’t been quantifying enough is the benefit we are receiving from this.

When you neglect to examine your incentive system. It may reach a point where it distorts economic growth since certain people gain while others don’t and because they operate in the same industry, they are unable to compete.

“So I can reassure you that looking at Nigeria’s incentive system is part of the mandate the President gave us.

“We can construct what is right for us as a country in terms of what we want to drive, so those incentives will be targeted, based on data and evidence,” he said.

According to Mr. Oyedele, this administration is putting a lot of effort into fostering sound fiscal governance, diversifying sources of revenue beyond taxes, and maximising non-tax revenues.

According to him, the goal was to reduce the amount of taxes that Nigerians had to pay while achieving a tax to GDP ratio of 18% during the following three years.

“So that seems contradictory, how do you cut taxes and collect more, but it’s simple to explain because we know where the gaps are; the anticipated tax gap, which is what you should collect today if people paid the appropriate amount of taxes, is somewhere in the neighbourhood of N20 trillion.

“In order to close that gap, we will rely on automation and improved collection efficiency, which includes harmonising the way those taxes are collected.

“The second issue is, if you also take into account the incentive rationalisation, maybe what we should be giving away isn’t N6 trillion, maybe it’s N2 trillion, and it needs to be directed at the people who need it the most.

And the strategy to raise tax revenue via expanding the economy is even more intriguing, according to Mr Oyedele. If you enable people to develop and businesses to flourish, then you inevitably generate revenue, he added.

He claimed that initiatives were being made to remove significant barriers to doing business in Nigeria in order to promote economic growth and inclusive development.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now