The Federal Executive Council (FEC) has authorized a $2.2 billion external borrowing financing program, which may include an offer of Eurobonds and Sukuk bonds.

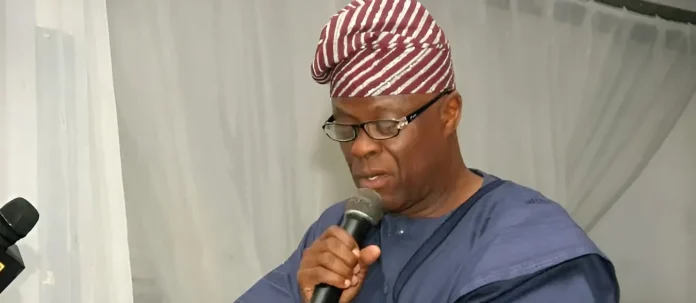

This was revealed to reporters at the Presidential Villa in Abuja on Wednesday following the FEC meeting by Mr. Wale Edun, the Minister of Finance and Coordinating Minister of the Economy.

In the recent Federal Executive Council meeting, I had the honor of introducing two memoranda to the group.

The first was to approve a $2.2 billion financing scheme in order to finish the Federal Government’s external borrowing program.

Access to the global capital market for a mix of the Sukuk and Euro bond offers, as well as maybe a Euro bond worth roughly $1.7 billion, make up this package.

Once the National Assembly has reviewed and, ideally, approved the borrowing plan, the real financing will be completed with sukuk financing of an additional $500 million.

“If approved, external borrowing will be completed this year, as soon as possible after approval.”

“What the advisors would say about market conditions at the time of the decision to enter the market would determine the actual combination of instruments that would be raised,” he stated.

Naturally, earlier this year, we demonstrated the depth of the Nigerian financial markets’ resiliency, as well as their growing sophistication and complexity, by issuing dollar bonds domestically, which drew in Nigerian investors from all over the country.

Access to the global capital market, he added, is another indication of support and acceptance for the macroeconomic policies of the administration of President Bola Tinubu.

Read Also: Akeredolu’s brother declares support for SDP candidate

According to the minister, the macroeconomic pillars of foreign exchange and PMS market pricing were the main focus of the economic recovery and restoration program that was implemented to turn the economy around.

Additionally, he said that the FEC had authorized the Ministry of Finance’s real estate investment fund.

The fund provides the foundation for the Nigerian economy’s recovery and the reintroduction of long-term mortgage lending, he claims.

“The Morph Real Estate Investment Fund would initially be a N250 billion fund that will offer long-term, affordable mortgages to Nigerians who wish to own homes.

The yawning housing deficit of 22 million units will be partially or completely filled by it. Of certainly, it will boost economic growth and provide jobs.

Additionally, it will create opportunities for additional private sector investors to enter and take part in the crucial home construction sector, which will have a significant positive impact on the entire economy.

“Long-term investors can profit from market interest rates on their investments.

He stated, “This will be combined with N150 billion in seed funding.”

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now

![Senator Akpabio, His Senate Team Meet with Governor Wike [PHOTOS]](https://tvn.ng/wp-content/uploads/2023/05/IMG-20230523-WA0040-324x235.jpg)