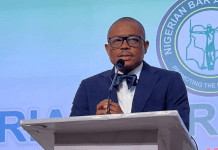

Mr. Godwin Emefiele, the Governor of the Central Bank of Nigeria (CBN), yesterday ruled out any further extension of the apex bank’s regulatory forbearance on its intervention facilities, which were established to mitigate the impact of the COVID-19 pandemic on companies and businesses.

He claims that the global economy has since opened up, with trade restrictions lifted and increased revenues for companies and businesses, necessitating the need for borrowers to begin repaying their loans.

While speaking to journalists after the two-day meeting of the CBN’s Monetary Policy Committee (MPC) in Abuja, Emefiele stated that he does not believe the forbearance program will result in loan default.

Read Also: Nigerians can’t survive another four years under the APC, say PDP governors

This comes on the heels of the MPC’s decision yesterday to maintain all monetary policy parameters, including the Monetary Policy Rate (MPR), also known as the interest rate, at 11.5 percent, with an asymmetric corridor of +100/-700 basis points around it.

The MPR is the rate at which the Central Bank of Nigeria lends to commercial banks, and it is often used to determine the cost of borrowing in the economy.

The MPC also voted to keep the Cash Reserve Ratio (CRR) and Liquidity Ratio at 27.5 percent and 30 percent, respectively.

Emefiele said the current policy stance had so far supported growth and recovery, and he was pleased with the slowing of inflation, which had fallen for six months in a row.

The apex bank and other financial institutions had devised forbearance packages for businesses to help them weather the storm in an effort to mitigate the negative effects of the pandemic on Nigerians and businesses.

The restructuring of loan repayment plans, a moratorium, and the CBN lowering interest rates on all of its intervention programs to 5% from 9% until March 2022 were all part of the program.

Following threats posed by the Delta variant of the virus, the CBN had twice extended the moratorium.

Read Also: Senate Gives Committee Today’s Deadline to Finish Budget Defense for Fiscal Year 2022 Appropriation Bill

However, as the forbearance period comes to an end in March of next year, the CBN governor urged businesses to resume loan repayments, citing improved economic activity.

“If you recall, from our perspective, we granted a forbearance regime in only two areas,” he said.

“One had to do with the fact that we said all loans to companies and businesses that are negatively impacted by COVID-19 should be given about two years; we started by saying one year, from 2020 to March 2021, and then we extended it by one year when the Delta strain of the pandemic continued in February 2021.” That gave it a two-year period that would end in March 2022.

“Another aspect had to do with the fact that we said we needed to reduce the interest rate from 9% to 5% for CBN interventions.” Indeed, because we knew that the negative effects of COVID-19 would result in a reduction in the revenue-generating capacity of businesses and companies, we allowed banks to allow their customers to request a restructure of their facilities as part of the intervention or forbearance. If it’s a two-year facility, it could be extended to four years to alleviate the cash flow burden on them.”

“And those were the periods when the global economy was locked down in unprecedented ways,” Emefiele continued. Without exception, all countries were put on lockdown. Travel was halted, and people were not permitted to leave their homes, which lasted for three to four months in Nigeria.

“Now, starting around September/October 2020, Nigeria began a process of easing the lockdown, despite the fact that the Delta strain reappeared around February/March 2021. We still believe that businesses should be able to exercise this patience.

“At this time, we believe that the global economy has opened up; the lockdowns have been lifted, and we know the economic damages and fatalities that have resulted as a result of that, and I am confident that not many countries, if any, will want to embark on a wholesome lockdown any longer in the midst of this pandemic.”

“In particular, because most countries are all administering vaccines that they believe will help to reduce the virus’s impact.”

Read Also: NCDC says highly infectious Delta Covid-19, a dominant variant in Nigeria, urges people to get vaccines

“We believe that businesses/companies in Nigeria are back in business, that revenues have improved, and that if revenues have improved, then companies or businesses that took loans have improved as well.” If we assume that the loans for intervention facilities increased from five to nine, that the two-year moratorium expires in March 2022, and that the restructure from which you benefited remains, then we should expect companies to be able to repay their loans.

“As a result, we do not believe there will be an increase in NPLs.” Indeed, we have worked very hard to bring NPLs down from as high as 9% about two years ago to the current level of 5.3 percent, and we are pleased that we are aggressively working to bring NPLs down to the maximum threshold set by the CBN. So I don’t think there’s any reason for anyone to be concerned.”

Concerns about arbitrary transaction charges by banks were also addressed by the CBN governor, who urged bank customers to study the Guide to Bank Charges and challenge any discretionary deductions that do not follow the guide.

“Talking about bank charges, the CBN insists that consumers of bank services, in this case, customers, must insist, and indeed, if it’s not on the CBN website, I’m going to ask that we put it on our website- the Guide to Bank Charges- go read your guide to bank charges,” he said.

“You should not allow any bank to impose on your account any discretionary charges that are not listed in the bank charges guide.” As you deal with the bank, treat it as if it were your bible. Raise an alarm if you find any that aren’t consistent.

“We have a consumer protection department, and we have always advertised our hotlines and emails where you can always reach us,” he said. “There have been cases in the past where people have raised an alarm, and it has resulted in hundreds, if not billions, of naira being reverted back to customers’ accounts.”

Read Also: Tambuwal claims that Nigeria will not require parochial or provincial leader in 2023

“So, if you’re being charged by a bank for transactions that didn’t happen or charges that aren’t inside or stated in the bank charges guide, you should ask the bank to reverse it because it’s not supposed to be there.”

However, Emefiele, who read the MPC’s communiqué, stated that the MPC was pleased that its previous policy actions had begun to yield positive results, citing the remarkable increase in GDP to 4.03 percent in Q3 2021 and the 6th consecutive month of inflation moderation to 15.99 percent in October 2021.

He stated that, given its level of confidence in the efficacy of its actions on macroeconomic variables, the MPC believes that, while tightening would help to aggressively rein in inflation, it would also raise the cost of funds and constrain output growth.

Loosening, on the other hand, will lower policy rates, relieve liquidity pressures, and stimulate additional credit creation, all of which will boost output growth, according to him.

“MPC also believes that loosening will widen the negative real interest rate gap and compound price distortions in the money markets, potentially fueling inflationary pressures,” he writes. In deciding whether to maintain its current policy stance, the MPC believes that the current monetary policy stance has aided the recovery of the economy and that it should be allowed to continue for a little longer to allow for consolidation in order to achieve the MPC mandate of price stability that is conducive to long-term growth. A hold stance, the Committee believes, will allow it to carefully assess the implications of the unfolding global development surrounding policy tapering and normalization by advanced economies.”

read Also: Attacks/abductions: Senators from Zulum, Borno meet with the Defense Chief in Abuja

The Committee singled out the CBN’s Targeted Credit Facility (TCF) for its contribution to poverty alleviation at the grassroots, he said, adding that the MPC urged the bank to continue its support through the TCF to ensure that more people benefit from the program.

He also stated that, in light of the US Federal Reserve’s announcement to begin monetary policy normalization and central banks’ impending interest rate hikes in some advanced economies, the MPC urged the federal government to step up its efforts to pursue a counter-cyclical fiscal policy in light of the impending tightening of external financial conditions.

As a result, Committee members expressed concern that this group of economies’ gradual normalization of monetary policy would stifle the recovery of several emerging market and developing economies in the short to medium term due to the sharp reversal of capital flows.

The committee also assessed developments in China, including the recurrence of the pandemic, power outages, and a property market crisis, noting the potential impact on Nigeria as a major trading partner.

Read Also: Tinubu Starts Reconciliation Process With Kwara APC Stakeholders

As a result, the committee urged the CBN to ensure that the necessary buffers are in place to protect the economy from the negative effects of these developments.

In general, members expressed confidence in the monetary and fiscal authorities’ current policies, which they saw as the cornerstone of the country’s current recovery and restoration of macroeconomic stability, and urged both to look beyond the current situation and plan for attracting long-term investment flows to Nigeria.

Investors are scrambling for the first bank shares, says CBN Governor.

In response to a question about the current situation at FirstBank Nigeria Limited, Emefiele said the financial institution was too important to be in a tussle for a majority stake.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now