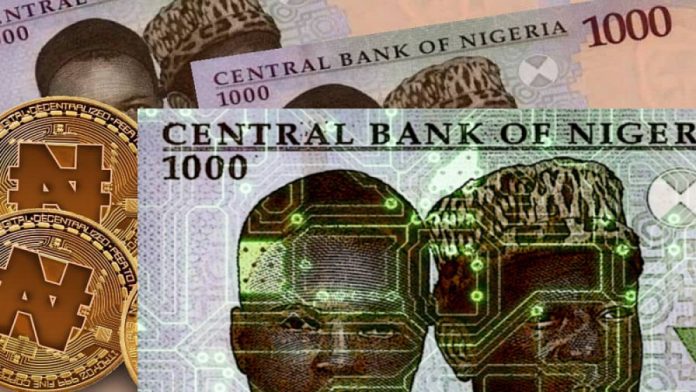

Nigeria’s Central Bank established an initial non-account transaction limit of N50,000 in preparation for its digital currency to commence October 1.

In a guide issued by Apex Bank for depositing banks, the CBN set a transaction limit for customers, the CBDC status of the central bank, and a book value limit.

Crisis of Jos: Security around the Plateau Assembly

The letter: Jos crisis’ fake news; Hezbollah double standards; PDP agreement

The CBN “Speed Wallet” is issued in three levels primarily to meet the 1st October deadline.

As a way to transact value, the wallet does not compete with existing banks, but awaits banks and other innovators to create wallets.

Read Also: CBN releases $200 million to all commercial banks in the country to meet legitimate end-user demand

Level One

The first level allows Speed Wallet to be used by anyone who has no bank account. Users will however have to submit a passport photo, a name, the date and place of birth, their telephone number and address.

A limit of N50,000 is in place for “sending & receiving.” The minimum requirement is the National Identity Number (NIN) of the person to be validated. Every day a cumulative balance of N300,000 is set.

Level Two

For Tier Two wallet users, an account with an existing bank is required.

The user can only send N200,000 per day and receive it with a cumulative balance of N500,000 per day. The minimum requirement for this level is a Bank Verification Number (BVN).

Read Also: CBN will arrest and prosecute Naira abusers

Three Tier

Tier 3 allows N1 million daily transactions, with a cumulative daily balance of N5 million. To qualify, you must have at least one BVN.

Those who have this level of merchants can send or get one million naira every day. A merchant can transfer as much money in their bank accounts as they want.

However, in the context of further disclosure, no fee is charged to either traders or customers using the wallet.

The report says that e-Naira is a legal tender for the country as a whole. It also stated that it will have non-interest-bearing CBDC status, a customer transaction limit and a value-based transaction limit.

The CBN also said that Nigerian banks can invite all their customers to register for e-Naira.

“Banks can send the invitation codes for onboarding to a specific list of selected clients, apart from pre-generated codes. Customers with a code assigned by their banks will receive the onboarding. These clients have already been validated and verified by the banks.”

It also revealed that its institution’s wallete was simply a deadline measure since banks and other licensed operators could supply their own wallets, because they did not intend to compete with the banks.

Read Also: CBN has ordered banks to freeze the accounts of 18 companies

“The e-naira system, as a national critical infrastructure, will be subject to a comprehensive security check and all data and personal information will be retained outside the booklet and not stored on the booklet,” added the Apex bank.

Banks facilitate onboarding and provide global customer service to catalyze the adoption of e-Naira.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now