CBN releases a platform to advance fintechThe Central Bank of Nigeria unveiled SabiMONI, an online learning platform, on Monday in an effort to advance financial inclusion and financial literacy.

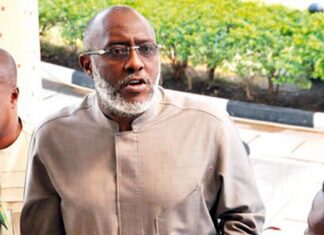

The platform, according to CBN Governor Godwin Emefiele, who spoke at the event, is a fully digital national e-learning platform that offers a knowledge base for financial literacy.

Read Also: Dana Air presents One-year free tickets for Hilda Baci

He claims that the purpose of SabiMONI is to give people the chance to self-serve their way through training and certification as Certified Financial Literacy Trainers.

“The platform is intended to support our efforts toward increasing the number of experts that can be used to lead financial education in the nation and possibly beyond.

“There is no doubt that financial literacy is one of the main forces behind financial inclusion today.

It is necessary for greater financial inclusion, which in turn would result in financial system stability and, ultimately, economic growth and development, he said.

Financial inclusion is hampered, according to Emefiele, by a lack of or poor levels of financial literacy.

In other words, the degree of financial literacy and capability directly influences the rate of financial inclusion.

The National Financial Inclusion Strategy 2022, he claimed, identified increasing adoption and usage of financial services in priority demographics as a solution to the financial inclusion gaps.

He claimed that these groups included the most vulnerable populations, including women, young people, MSMEs, and people who live in rural areas.

“Among its strategic priority areas are, in particular, the North of the nation as well as the growth of digital financial services and platforms.

“Through financial education programs, we must take deliberate steps to upscale financial capability in order for us to be able to achieve these.

The lack of knowledgeable and qualified individuals to lead financial education continues to be a significant barrier.

It’s interesting that the National Financial Inclusion Strategy 2022 gives financial and digital learning a high priority.

“This will serve as a strategy that would enable the creation of a conducive environment for serving or ensuring the inclusion of the most excluded groups,” he claimed.

Financial literacy is still a major factor in driving financial inclusion globally, according to Mrs. Rashida Monguno, Director of Consumer Protection at the CBN.

It includes knowledge and abilities, in her opinion, that allow people to effectively manage financial resources in order to improve their economic well-being.

“However, it also involves faith, confidence, and involvement in the legal financial system.

“Consumers who understand finances are always able to make wiser financial decisions. This is a catalyst for greater financial inclusion and financial system stability, she claimed.

She claimed that with a current rate of 64.1%, financial literacy was still not widely spread in Nigeria.

“There is no doubt that the lack of qualified financial literacy instructors and the few available resources for financial education may not be unrelated.

According to the most recent findings of the Access to Finance Survey conducted by Enhancing Financial Innovation and Access, the lack of financial literacy continues to be a barrier to financial inclusion, Monguno said.

According to her, SabiMONI was created as a means of promoting financial literacy among the target population of Nigeria in order to facilitate financial education programs for end beneficiaries.

“It will also assist with initiatives to improve financial inclusion through digitalization.

It would act as a means of promoting digital financial literacy, which would increase the uptake and use of digital financial services.

With the introduction of the SabiMONI platform, she said, “we now have a knowledge base where people can easily learn about financial literacy at their own pace from the comfort of their own homes.”

The platform is intended to support efforts to increase the number of experts who can be used to drive financial education, according to Mrs. Aisha Ahmad, Deputy Governor, Financial System Stability of the CBN.

Financial literacy is one of the main forces behind financial inclusion, according to Ahmad.

“It is a necessary condition for greater financial inclusion, which would result in the stability of the financial system and, in the end, economic growth and development.

Financial inclusion is hampered, according to research, by a lack of or low level of financial literacy.

In other words, the degree of financial literacy and capability directly influences the rate of financial inclusion, according to the speaker.knowledge of race

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now