According to former Vice President Atiku Abubakar, corruption, not infrastructure or development needs, is the driving force behind the loans that the President Bola Tinubu administration has obtained.

In a letter to the National Assembly on Tuesday, Tinubu requested their approval of a new external borrowing plan in the 2024 Budget (Appropriation Act) worth N1.767 trillion ($2.209 billion).

Nevertheless, the National Assembly granted Tinubu’s request less than 48 hours later, in spite of the objections expressed by experts and civil society.

The loan will be used to partially pay the N9.7 trillion budget shortfall for the 2024 budget if it is authorized.

Read Also: FCTA Relocates 11,000 Apo mechanic traders to Wasa

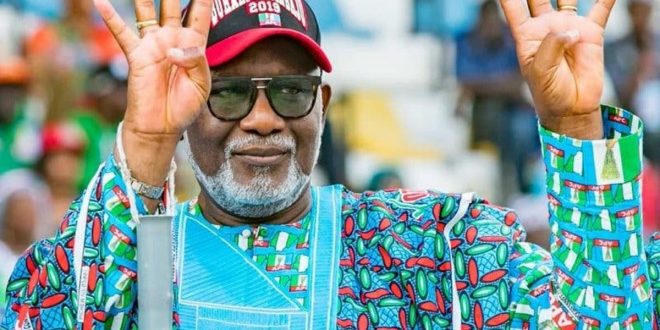

Former PDP presidential candidate Atiku, however, stated that this loan proposal is more worrisome because it is benchmarked at the exchange rate of 1 USD to N800, but the Central Bank of Nigeria’s current exchange rate is more than N1,600 to 1 USD.

In a statement, Atiku said that the National Assembly has once again turned into an accomplice as Nigeria’s debt continues to grow, presumably alluding to its approval of loan requests during the most recent Muhammadu Buhari administration.

Nigeria’s public debt stock, which includes both domestic and foreign debt, increased by 75.27% on a quarter-over-quarter basis from N49.85 trillion (US$108.30 billion) in Q1 2023 to N87.38 trillion (US$113.42 billion) in Q2, according to the Nigerian Bureau of Statistics (NBS).

“Total domestic debt was N54.13 trillion (US$70.26 billion) in Q2 2023, while total external debt was N33.25 trillion (US$43.16 billion),” the NBS added.

However, Atiku said, “It is extremely alarming that the World Bank recently released a report indicating that Nigeria is the third most indebted nation to the International Development Association (IDA).”

This report comes right after the administration issued a proposal to the National Assembly indicating that it intends to use Euro Bonds to borrow an additional N1.7 trillion to cover the 2024 budget shortfall.

The benchmark for this specific loan request is 1 USD to N800, which is even more worrisome given that the Central Bank of Nigeria’s current exchange rate is more than N1,600 to 1 USD.

“The National Assembly has once again turned into an accomplice as Nigeria’s debt continues to grow. In July of this year, Tinubu boasted that the Customs and FIRS under his control had brought in record-breaking amounts of money to fund the budget. So why do they continue to borrow? Even if their lending rackets and failed trial-and-error strategies are crushing Nigerians, there is something they are not telling them.

Read Also: Bank of Industry secures $5bn, earmarks N120bn for MSME support

“These Tinubu loans are crushing Nigerians’ bones and putting unbearable strain on the economy, particularly when they are not properly utilized and negotiated.”

It is alarming that corruption, rather than infrastructure and development needs, is driving the avaricious thirst for these enormous loans. The amount of pork in the 2024 budget has made it a shambles, according to a report by budget watchdog Budgit.

“Seeing that we are back at the top of the same dilemma just a few years after President Obasanjo’s administration pulled our nation out of foreign debt causes me personal anguish.”

He declared, “It’s time we exercise greater prudence and apply math to the loan frenzy.”

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now