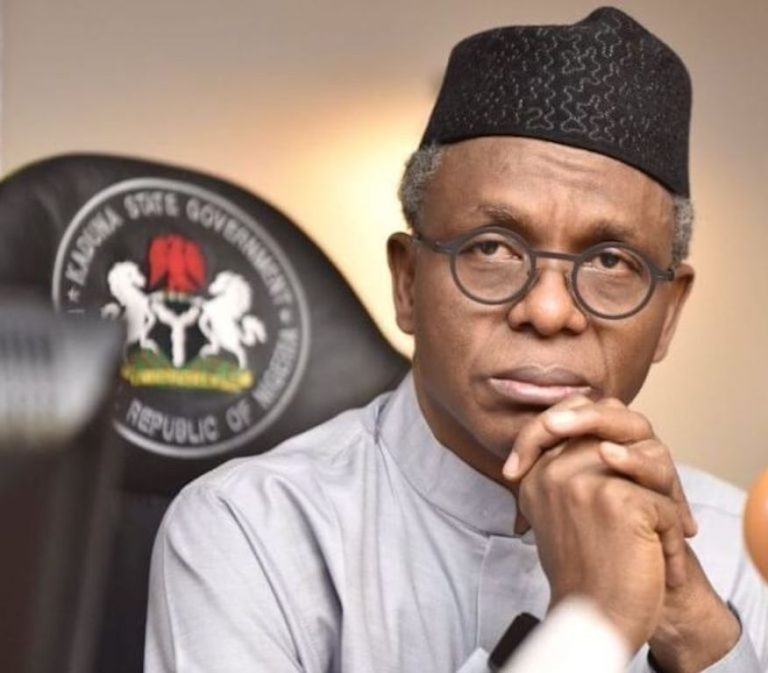

The recent disclosure by Kaduna State Governor Uba Sani regarding the staggering debt he inherited from his predecessor, Nasir El-Rufai, has sparked concerns about the state’s financial stability. With a debt burden of N85 billion and $587 million weighing down on the government, the ability to meet financial obligations, especially the payment of salaries to civil servants, is severely compromised. The implications of this massive debt load on Kaduna’s finances are dire, with long-term repercussions for the people of the state. In the face of this crisis, urgent action is needed to address and mitigate the impact of this financial challenge on the welfare of Kaduna’s residents.

According to Governor Sani, this massive debt burden has made it difficult for the state government to meet its financial obligations, including the payment of salaries to civil servants. In light of this troubling revelation, it is imperative to analyze the potential implications of such a significant debt load on the state’s finances and the long-term repercussions for the people of Kaduna.

First and foremost, it is important to estimate how long it will take for Kaduna State to repay this staggering amount of debt. Without detailed information on the state’s current revenue streams, debt servicing costs, and debt repayment schedule, it is difficult to provide an accurate estimate. However, based on a rough calculation, if the state were to allocate a significant portion of its annual budget to debt repayment, it could potentially take several years, if not decades, to fully pay off the debt.

The sheer volume of debt inherited by Governor Sani raises serious concerns about the level of financial mismanagement and irresponsible borrowing practices under the previous administration. Such a massive debt burden not only hinders the state government’s ability to provide essential services and invest in critical infrastructure projects but also creates a significant financial burden for future generations of Kaduna residents.

The question arises as to what extent the amount of debt could have been utilized for development projects in the state. With N85 billion and $587 million at its disposal, the Kaduna State government could have undertaken a wide range of critical development projects, including infrastructure upgrades, healthcare facilities, education initiatives, and job creation programs. However, the mismanagement of these funds and the accumulation of such a significant debt load have severely limited the state’s capacity to invest in much-needed development projects.

The mismanagement of funds and the accumulation of such a significant amount of debt have severely constrained the state’s ability to initiate and complete these much-needed projects. Instead of investing in the future of Kaduna and its people, the state is now grappling with the burden of servicing its massive debt, leaving little room for meaningful development initiatives.

It is worth noting however, that Uba Sani, played a significant role in enabling his predecessor, Elrufai, to obtain the crippling debt burden that he is now complaining about. During his time in the Senate, Sani actively supported and facilitated several of the borrowing plans proposed by Elrufai, which have now put immense strain on the finances of the state.

It is important to recognize that the decisions leading to this debt crisis were not made in isolation. Uba Sani, as a key figure in the Senate, was part of the scheme that allowed Elrufai to secure the loans that are now causing economic hardship for the state.

While it is easy to criticize Elrufai for his handling of the state’s finances, it is crucial to also hold accountable those who played a role in enabling these decisions. Uba Sani’s involvement in facilitating the borrowing schemes during his time in the Senate cannot be overlooked.

It is important for policymakers to learn from past mistakes and work towards more sustainable financial practices. The debt burden facing Kaduna state is a stark reminder of the need for responsible governance and prudent decision-making. it is imperative that all stakeholders, including Uba Sani, acknowledge their roles in the creation of this crisis and work towards finding viable solutions for the future.

The state of Kaduna now faces a daunting challenge in repaying its debts and meeting its financial obligations, which will undoubtedly have far-reaching consequences for its residents. As the state grapples with this financial crisis, it is important that measures are put in place to ensure transparency, accountability, and responsible financial management to prevent a recurrence of such a dire situation in the future.