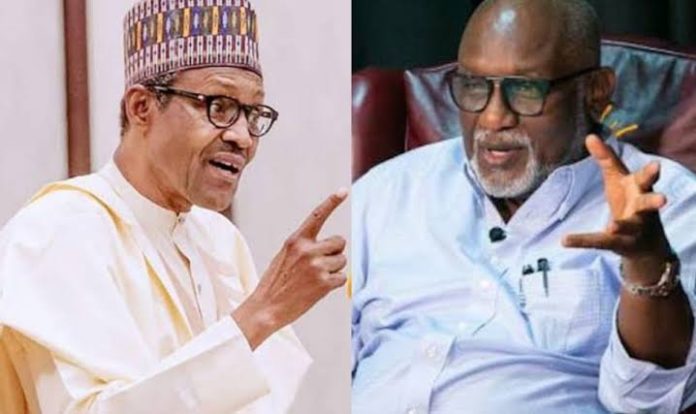

The Central Bank of Nigeria issued a directive limiting daily cash withdrawals from banks, and the Ondo State Government has filed a lawsuit against the Federal Government in that regard before the Supreme Court of Nigeria in Abuja.

Ondo state government is asking the Supreme Court to block the implementation of the directive issued by the Federal Government through the Central Bank of Nigeria on the limitation of daily cash withdrawals from banks, which has completely paralyzed and brought to a standstill the activities of Ondo state government and has negatively affected economic and co

The federal government’s daily cash withdrawal limit guidelines, according to the Ondo State Government, violate the legal rights of the state’s government and its residents to access funds for the implementation of development projects, to grant small credit facilities to petty traders (who do not have accounts in banks), and to the state’s regular commercial activities.

The Ondo State Government urged the Supreme Court to rule that the Federal Government cannot amend or vary an existing Act of the National Assembly by directive issued through the Central Bank of Nigeria, particularly Section 2 of the Money Laundering Act, which specifically relates to limitations on cash withdrawals for individual and corporate organizations to five million naira and ten million naira, respectively. The maximum withdrawal for an individual or corporate entity is now N500,000 and N5,000,000, respectively, according to the CBN’s updated guidelines.

The federal government’s guidelines on the maximum daily cash withdrawal, as well as the ongoing suffering and hardship brought on by the implementation of the said policy, are being challenged by the Ondo state government in the Supreme Court. The state is asking the court to rule on whether or not these regulations violate Section 2 of the Money Laundering Act as well as Sections 20, 39, and 42 of the Central Bank of Nigeria Act.

The Ondo state government claimed that, despite having more than 149 Ministries, Departments, and Agencies to manage on a daily basis in a state with more than three (3) million residents, fewer than 500,000 people have bank accounts that can be used for bank transfers. As a result, the state’s economy is completely paralyzed as a result of federal government policy.

The Ondo state government claimed that while its citizens now waste valuable time waiting at bank ATMs to withdraw the new Naira notes, those living in rural areas and remote villages without access to banks or internet services are unable to receive or transfer money to cover their basic needs.

The Government pleaded with the Supreme Court to step in and prevent further application of the aforementioned Federal Government policy.

In a related matter, the government of Ondo state applied to the Supreme Court in order to join the lawsuit brought by the states of Zamfara, Kaduna, and Kogi regarding the window of time during which citizens and the government may exchange old Naira notes for new ones. Sir Charles Titiloye Ksm FCArb, the Attorney General and Commissioner for Justice of Ondo State, requested that the Supreme Court join Ondo state government in the earlier lawsuit brought by the aforementioned three states opposing the deadline of February 10, 2023 for the Central Bank of Nigeria to replace Old Naira Notes with New Naira Notes in a motion on notice signed and submitted on Thursday, February 9, 2023.

The Attorney General made a point of pointing out that the government and people of Ondo State are currently going through the same severe economic and financial hardship brought on by the said incoherent demonetization policy that the Federal Government is currently implementing through the Central Bank of Nigeria.

A lawsuit against the Federal Government over the Central Bank of Nigeria’s naira redesign policy was also filed on Thursday evening at the Supreme Court by the Abdullahi Ganduje-led government of Kano.

The Kano State Attorney General is requesting that the Supreme Court rule that Major General Muhammadu Buhari (ret.), the president, cannot unilaterally order the Central Bank of Nigeria (CBN) to recall the now-outdated N200, N500, and N1,000 banknotes without first consulting the Federal Executive Council and National Economic Council, respectively, in suit number: SC/CS/200/2023, which was spotted by The PUNCH.

Due to the policy’s negative effects on the economic wellbeing of more than 20 million Kano residents, the Kano government is requesting a mandatory order to reverse the Federal Government’s decision to remove the N200, N500, and N1,000 notes from circulation.

The applicant is also requesting a mandatory order compelling the Federal Government to reverse its policy regarding the naira redesign because it is alleged to be in violation of the 1999 Constitution (as amended).

In a similar vein, the applicant is pleading with the Supreme Court to issue an order compelling the Federal Government to change its cash swap policy because it allegedly violates the 1999 Constitution and other laws currently in effect.

A statement that the President cannot unilaterally approve the Central Bank of Nigeria for the implementation of the cash withdrawal limit pursuant to the demonetization economic policy of the Federal Government of Nigeria without recourse to the Federal Executive Council and National Economic Council, respectively, is made in the lawsuit.

The Kano State Government also requested a declaration that the president’s order to the CBN to implement the cash withdrawal limits policy in response to the demonetisation of the Federal Republic of Nigeria without first consulting the FEC and NEC, respectively, was illegal, invalid, and contrary to the constitution.

The applicant is also pleading for a court order that would make the Federal Government stop its practice of recalling old banknotes for allegedly failing to follow the Constitution’s requirements and other existing laws.

Remember that in an ex-parte application by the three applicant states, including Kaduna, Kogi, and Zamfara, the Supreme Court issued an interim order to the CBN on Wednesday telling it not to stop using old naira notes on February 10, 2023.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now