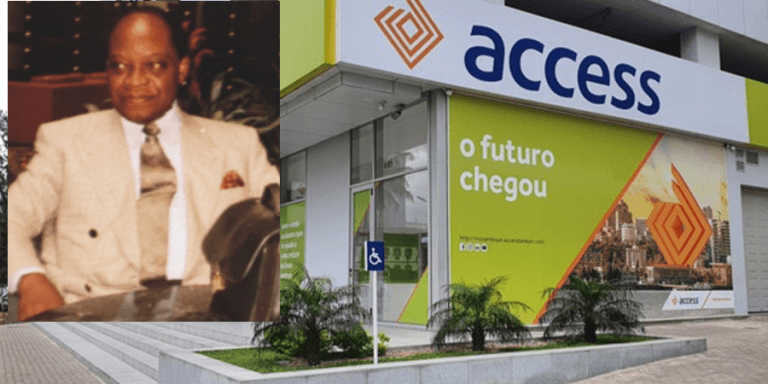

Last week, Access Bank Plc began the process of collecting outstanding sums due it from a total judgment debt of over N50 billion in its favor against the late Chief Sunny Odogwu and two of his companies, Robert Dyson & Diket Limited and SIO Property Limited.

The judgment debt was for a property known as Luxury Collection Hotels and Apartments, which was located on No. 31 – 35, Ikoyi Crescent, Ikoyi, Lagos State (formerly Le Meridien Grand Towers).

The property was financed with a loan from the then-Diamond Bank, which is now Access Bank, and owned by SIO Property Limited, of which the late Odogwu was the majority shareholder.

In suit number FHC/L/CS/1633/14, Justice Saliu Saidu of the Lagos Division of the Federal High Court found the late Odogwu and his companies guilty of breach of bank-customer relationship and ordered the sale of the property used as collateral for the loan sum of N26,229,943,035.22.

However, the total debt has now risen to over N50 billion due to a 20% interest rate on the N26 billion judgment debt over the last six years since the judgment was delivered.

Following the defendants’ failure to meet their loan obligations granted in the financing of the Le Meridien Grand Towers, known as Luxury Collection Hotels and Apartments, the bank filed a lawsuit against them in a Federal High Court in Lagos in 2014.

While Access Bank was the sole plaintiff, the first to sixth defendants were Robert Dyson & Diket Limited, SIO Property Limited, Odogwu, the Corporate Affairs Commission (CAC), the Registrar of Title Federal Land Registry, and Leadway Trustee Limited.

Plaintiff presented a slew of evidence to the court in support of its case, including how it granted various credit facilities to the first and second defendants to fund the construction of the Luxury Collection Hotels and Apartments.

The project site located at 31-35 Ikoyi Crescent, Ikoyi, Lagos, and the Personal Guarantee of the late Chief Sonny Odogwu were used as collaterals for the facility, according to the plaintiff, who stated that the various facilities were restructured at various times to ease the repayment of the loan facility, but the 1st to 3rd defendants continued to refuse or fail to meet their obligations.

Read also: Centre hails NPHCDA boss, Faisal Shuaib, over TheNigerian News award

Whether having regard to plaintiff’s massive investment/financing of N26 billion in the 1st to 3rd defendants project, and by the various agreements entered between plaintiff and the 1st to 3rd defendants to create a legal mortgage in favour of the plaintiff, a beneficial owner of the property on No 31 – 35 Ikoyi Crescent, Ikoyi, Lagos State, and the 1st to 3rd defendants’ breach of the terms of the agreement by the

“Whether, having regard to the 3rd defendant’s failure, refusal, and or neglect to execute the deed of personal guarantee as agreed with the plaintiff on November 19, 2010 as part security for the cumulative sum of facility advanced to the 1st to 3rd defendants for the project at 31 -35 Ikoyi Crescent, Ikoyi, Lagos State, which now stands at N26 billion as of September 30, 2014, order an order of specific performance can be made to compel the 3rd

Justice Saidu ruled that the first to third defendants had admitted “Indebtedness to the plaintiff in the sum of N10, 252,315,567.28 on the project finance facility as at December 20, 2011” and thus were in fundamental breach of the contract for the financing of the construction of the Luxury Collection Hotels and Apartments.

The judge stated that if a party admits to being in debt, the court can make an order for the amount admitted to be paid.

“From the totality of the evidence before me, it is clear that facilities have been granted and disbursed….the facts of these facilities were admitted in paragraphs 8, 10, 11, 13, 14, 15, 16, and 17 of the counter affidavit.

The court stated, “I have not seen anywhere in the pleadings of the 1st to 3rd defendants that they did not enter the contract as shown in exhibit DB3, with the agreed collateral being a third-party legal mortgage on the parcel of land located at No 31 – 35 Ikoyi Crescent, Ikoyi, Lagos State.”

Furthermore, the judge stated that the first through third defendants had not presented any evidence to the court that any of the conditions for the grant of the facility had been waived or that they had demonstrated to the court how they had paid off their debts.

“I am satisfied that the first to third defendants who have admitted indebtedness have not shown how the indebtedness was liquidated, based on all of the facts before me.”

Read also: After a three-day official visit to Turkey, Buhari returns to Abuja

“There are four possible responses to a debt allegation: admitting the debt, denying the debt, counter-claiming against the debt, and setting off against the debt.” The first to third defendants have only admitted the debt but have not shown how the admitted indebtedness was liquidated, based on all of the facts before me.

“When the first to third defendants fail to liquidate their debt, the court has the duty to order specific performance from the first to third defendants to honor their contract pledge.” According to the documentary evidence before this court, the 3rd defendant pledged to execute a third-party legal mortgage in favor of the plaintiff through the 2nd defendant.

“As a result, this court has the power to grant equitable relief of specific performance against the first to third defendants to do what they have agreed to do under the contract,” he added.

“Judgment is entered in the sum of N26, 229,943,035.22 jointly and severally against the 1st to 3rd defendants as at September 30, 2014, being the outstanding sum as at September 30, 2014 advanced by the plaintiff for the 1st to 3rd defendants project, which sum has remained unpaid despite several demands,” Justice Saidu said.

“That the plaintiff be granted leave to foreclose on and sell the said property located at 31 – 35 Ikoyi Crescent, Ikoyi, Lagos, and to deposit the proceeds of the sales into the 1st defendant’s account held by the plaintiff in partial satisfaction of the judgment sum against the 1st to 3rd defendants.”

“That the plaintiff be granted leave, under the supervision of the Court’s Registrar, to sell property located at No 31 – 35 Ikoyi Crescent, Ikoyi, Lagos, as security for the sum of N26, 229,943,035.22 advanced by the plaintiff to the 1st to 3rd defendants for the development of the project known as Luxury Collections Hotels and Apartments, the repayment of which facility the 1st to 3rd defendants have failed, refused,

“Within 30 days of this court’s judgment, the 3rd defendant is hereby ordered to execute the said deed of personal guarantee in the sum of N26, 229,943,035.22 in favor of the plaintiff.”

The judge also barred the 3rd defendant from disposing, selling, or alienating any of his personal assets, including money, shares, stock, and negotiable instruments, until the sum of N26, 229,943,035.22 owed to the plaintiff by the 1st to 3rd defendants is paid in full.

The court also ordered the sixth defendant to pay N49 million to the plaintiff as money it had and recovered for a failed consideration.

The sixth defendant was also ordered to surrender all title documents in its possession in relation to the property in question, as well as any other documentation related to or pertaining to the ongoing transaction in which the plaintiff is a beneficiary.

The Defendants appealed to the Court of Appeal in Appeal No. CA/L/1151/2015, but while the case was pending, the late Chief Sonny Odogwu died, and his numerous children attempted to dissipate the various assets charged to the bank, including the property located at 31-35 Ikoyi Crescent, Ikoyi, Lagos, which the Court has ordered to be sold.

The bank was forced to take steps to prevent the beneficiaries of the late Sonny Odogwu’s estate from dissipating the various assets acquired with depositors’ funds, which led to settlement discussions between the bank and the beneficiaries of the late Sonny Odogwu’s estate and the execution of Settlement Agreements.

The beneficiaries of the estate and children of late Odogwu have willfully and persistently refused to comply with the terms of the Settlement Agreement reached with the Bank. They have resorted to squandering assets pledged to the Bank, in violation of the consent judgment issued by the Federal High Court.

Read also: Six people convicted in Madagascar court over plot to kill president

For example, the defendants were required to sell the property in Los Angeles, California, within 60 days of the 30th of May, 2019 or otherwise assign their interest in the property to the Bank under the consent judgment. Without regard for the consent judgment, the defendants have failed to meet this condition and have instead compromised their interest in the property.

As a result, the bank has taken steps to sell the property at 31-35 Ikoyi Crescent, Ikoyi, Lagos to a new owner as the beneficial owner under the judgment.

Unfortunately, the beneficiaries of the late Odogwu’s estate, as well as other unidentified individuals who have been parading the property, have threatened to disrupt any takeover attempt.

Based on the foregoing, the bank is determined to recover the outstanding sums due from the defendants and enforce the Federal High Court’s judgment in order to protect depositors’ funds.