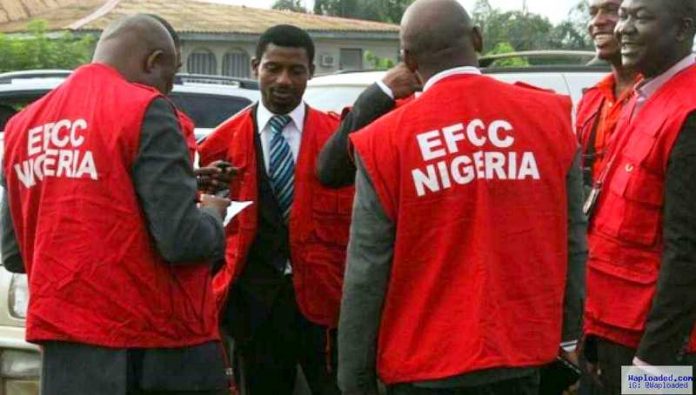

Mr. Abdulrasheed Bawa, Chairman of the Economic and Financial Crimes Commission (EFCC), drew the battle line on Tuesday following the discovery of a N157 billion pension fraud.

He stated that the EFCC will put an end to the country’s pension system’s rot.

Abdulkarim Chukkol, the EFCC’s Director of Operations, revealed that the anti-graft agency had looked into alleged pension fraud cases worth over N157 billion.

Bawa said the commission would implement the anti-fraud rules, speaking in Abuja at the start of a two-day sensitisation seminar on eradicating pension fraud in Nigeria.

“Nigeria operated the Defined Benefit Scheme for many years until 2004, when President Olusegun Obasanjo’s administration introduced pension industry reforms that announced the Contributory Pension Scheme,” he said (CPS).

Read Also: Police officers accused of stealing their phones after arresting protesters

“At the time, the new design was seen to be the antidote to the old order’s issues and flaws. But, after two decades of operation, it is clear that, while we have made some progress, we are still a long way from our goal. We can’t say how much money is wasted due to pension fraud because the vast majority of cases go unreported or underreported. The EFCC, on the other hand, has examined and recorded hundreds of billions of naira lost to pension fraud.

“However, in addition to the monetary loss, there is also the incalculable loss of dignity in the retiree who must grovel and beg (and in some cases, die) in order to access his contributions. It is a national disgrace that those who have devoted their most productive years to us in various capacities must endure misery in retirement.

“At the EFCC, we find that a large portion of the cases we come across while investigating public sector corruption are inextricably tied to the worker’s frantic attempts to escape the pitiful situations he observes among today’s retirees.

Read Also: Nigeria is not on UK COVID-19 red list countries to visit — FG

“As the coordinating agency for the enforcement of all economic and financial crime legislation in Nigeria, the EFCC is well aware of the rot in the pension system.

“Our sub-sector investigations, particularly in relation to the Police Pension Office and the Pension Office of the Office of the Head of the Civil Service of the Federation, among others, exposed us to a mind-boggling spectrum of fraudulent acts that cut across all industry players.”

Bawa reassured everyone that the country’s pension system was about to turn around.

“I am firmly convinced that the turnaround of the Nigeria pension system requires a wide national consensus, which must begin with maximising the impact of this summit,” he continued.

“At the EFCC, while we are implementing our preventive mandate through this summit and other soon-to-be-launched programs, we will continue to strictly enforce all Nigerian anti-fraud legislation.

“I guarantee you that we are both willing and capable of doing everything possible now to ensure that when we all pass to the other side of the road in retirement, we will truly live the lives of the PFA models!

“In fact, I am highly optimistic that the pension administration and fraud prevention reforms that will be the natural outcomes of this summit will be quickly implemented by all stakeholders for everyone’s immediate and long-term benefit.”

According to the EFCC chairman, President Muhammadu Buhari has shown that he has the political will to fight corruption in the country.

Read Also: EFCC arrests a suspect in connection with an N425 million internet fraud

“…I can tell you that one thing is unmistakable in Mr. President’s mind: when it comes to the fight against corruption, there is no shortage of political will to make painful decisions,” he said.

“Let me stress that the primary goal of this project, our entire hope, is for Nigeria to establish a pensions system that is transparent, responsible, and attentive to the requirements of the country’s most important, venerable, and vulnerable stakeholder – the retiree.

“We believe that by uniting our resources and knowledge, we can disrupt the Nigerian pensions system’s cycle of fraud, inefficiency, and mutual distrust.”

According to EFCC Operations Director Chukkol, there were 21 petitions filed between 2010 and 2016 alleging N111 billion in pension fraud.

“There was a case of 554 seniors’ pensions going into one person’s account,” he stated.

“The EFCC has looked into almost N157 billion in alleged pension cases. Including a N19.5 billion special case and a N5 billion lawsuit linked to a director.

Read Also: EFCC’s retrial of Orji Kalu for suspected N7.1 billion fraud has been halted by the court

“According to our findings, 70% of the money intended to pay retirees ended up in private pockets. We gave it our all, and we were able to recover a significant amount of evidence and secure 11 convictions.

“We observed that many pension offices lack a database, and those that have don’t keep it up to date. There is always the possibility of diverting pension monies.

“The majority of those who work in the pension office are quite wealthy. We will try to ensure that the entire system is altered. In 14 zones, we have Pension Investigation Units. Investigators have been dispatched to all of the zones.”

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now