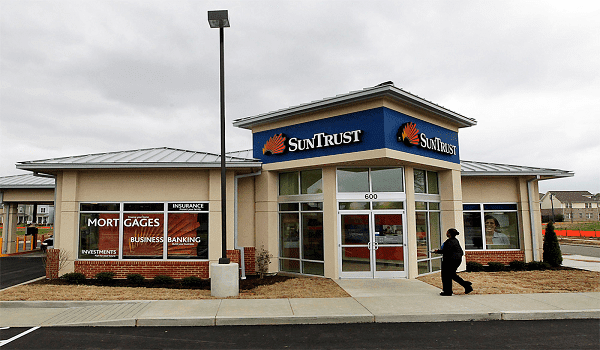

IN its dedication to earn the increase of the small and medium scale enterprises (SMEs) its principal focus, SunTrust Bank gave out N23.96 billion as loans and advances to the industry in 2019.

Addressing shareholders at the yearly general meeting in the weekend in Lagos, Chairman, SunTrust Bank Nigeria Limited, Olanrewaju Shittu stated despite the struggles of the year under review, SunTrust Bank managed to raise its balance sheet by 24.61 percent from N43.97 billion to N54.79 billion.

Managing Director, SunTrust Bank, Halima Buba, reiterated the commitment of the lender to the increase of the country’s economy through successful funding of the actual sector.

She said the bank was dedicated to the growth and maturation of the country’s economy through successful funding of the actual sector.

Read also: Afreximbank $30m loan deal: How SMEs can benefit

“As you can see we raised our advances and loans by 185.41 percent from N8.4 billion to N23.96 billion and now that I am assuring you that we can do more because we’re devoted to the development of the real sector, realizing fully that, that’s the sole ways to guarantee effective growth and advancement of our country’s market,” Buba said.

Based on her, in accord with the bank’s plan, it’s likely to aggressively drive SMEs trades and part of this plan is retail banking.

“we would like to make a retail bank of selection and surely SMEs is the engine area for the development of any market and also to give financing solutions, to encourage the SMEs is going to be the only way. We can encourage the development of the market and especially in accord with the vision of the CBN and the present government,” Buba said.

She expressed pleasure that clients had substantially increased their deposit into the bank to the tune of N25.7 billion, with a rise of 38.03 percent, adding that since the bank grows, more money will be put aside for corporate social responsibility to produce the communities and people flourish.

Read also: FG commences payment of N30,000 grant to taxi, bus, okada drivers

“The bank raised the headcount to guarantee greater business growth greater than the previous year. This one of other caused growth in consumer deposits compared with preceding year by 38.03 percent, from N18.64 billion to N25.73 billion, and growth in the bank’s overall assets from N43.97 billion to N54.79 billion,” Buba said.

She expressed optimism concerning the future of this lender presuming that despite the dangers to increase, the lender will make the most of opportunities presented from the forthcoming financial year to enhance earnings, profitability, and asset quality with a view to bringing value to its investors.

Read also: Buhari’s poverty alleviation, job creation programmes best in Nigerian history – Lai Mohammed

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now