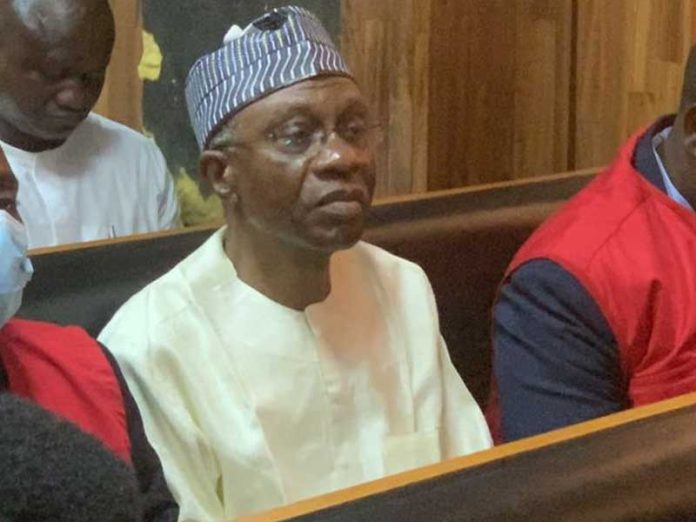

On Tuesday, Chinedu Eneanya, a witness for the Economic and Financial Crimes Commission (EFCC) in the trial of former Central Bank of Nigeria (CBN) Governor Mr. Godwin Emefiele, accused commercial banks of causing the shortage that followed the federal government’s Naira redesign policy in late 2022 and early 2023.

During cross-examination by Mr. Olalekan Ojo, SAN, Emefiele’s attorney, the witness—a Commission investigator—made the revelation.

The former CBN Governor is on trial for four counts that include revamping the Naira without the Board of the CBN’s and the Committee of Governors’ (COG) approval, as well as failing to obtain the consent of the late President Muhammadu Buhari.

The anti-graft agency alleged in the lawsuit, FTC/HC/CR/264/2024, that Emefiele violated Section 19 of the CBN Act between October 19, 2022, and March 5, 2023, by permitting the printing of 375,520,000 pieces of color-swapped N1,000 notes at a total cost of N11,052,068,062 without the CBN Board’s recommendation and the President of the Federal Republic of Nigeria’s strict approval, causing harm to the public.

The indictment claims that the offense was penalized under Section 123 of the Penal Code, Cap 89 Laws of the Federation, 1990.

Nonetheless, the defendant had refuted the accusation.

The witness presented video evidence during his Evidence-in-Chief, asserting that many Nigerians suffered greatly as a result of the Emefiele-led CBN’s redesign of the Naira notes.

However, Eneanya, the head of the Inter Ministerial Probe Panel and the seventh prosecution witness (PW7), disclosed claimed violations by certain commercial banks in the nation throughout the policy’s implementation in 2022–2023, while being cross-examined on Tuesday.

However, he stated that he couldn’t remember how many banks had employees hoarding currency.

“Can you confirm to the Honorable Court that bank officials were hoarding mints?” was the question posed to him.

He answered, “I am aware of that, but I cannot be specific.”

Furthermore, the witness was unable to establish whether the anti-graft agency had detained bank personnel who were supposedly in charge of stockpiling the cash.

In response, A.O. Mohammed, the prosecution’s attorney, said, “His beat was specific; whether his (naira redesign) was a valid approval.”

The witness, however, was not restricted to his evidence in chief, and as an investigative officer, he had the authority to make an arrest, Emefiele’s attorney said.

The anti-graft agency claims that Emefiele caused Nigerians unnecessary hardship because of the shortage of the redesigned coins, thus Ojo emphasized that the question was also essential.

The judge reacted by asking the witness to respond to the question after verifying his designation.

Eneanya replied, “I told this court that the EFCC established a task force; I didn’t say it was my team.” He also said he didn’t know what the EFCC did to the bank officials that resulted in the alleged violations.

The witness, meanwhile, claimed he was “not privy to that information” when asked to confirm under what authorization they visited the nation’s commercial banks.

The defendant’s attorney subsequently responded by asking for an adjournment and requesting access to all case-related papers.

In a succinct decision, Justice Maryanne Anenih postponed the witness’s cross-examination until March 19.

According to the witness, earlier in the day’s proceedings, Ahmed Halilu, the Managing Director (MD) of Nigerian Security Printing and Minting Plc (NSPM), gave the EFCC team access to the email exchange between De La Rue and himself.

“The MD of NMPS provided the email to my team, and it was then opened in front of the team,” he stated.

He acknowledged that he could not remember every statement Halilu had written.

Ojo requested the statements as a result of this.

He claimed he “could not remember” if the NSPM had ever created naira notes.

The witness was likewise unable to remember how many different currencies commercial banks had access to.

He asked to be given permission to review the documents in order to jog his recollection.

He responded, “We have a team that went nationwide in conjunction with other law enforcement agencies, taking stock and making sure that those currencies were made available in public,” when asked if the EFCC team had contacted the commercial banks to verify the precise sums sent to them.

He added that the team maintained a log of the inventory of the resources made accessible to commercial banks.

Ojo further requested that the defense be presented with the records.

The witness stated that he “was not there in all the teams” when asked if the EFCC also examined bank vaults.

Just fifteen minutes prior to the start of the day’s hearings, Emefiele’s attorney told the court that they had only received the Investigative Report that the defense had requested at the previous hearing.

But according to the EFCC attorney, “the decision to produce the Investigative Report was not made to deprive the defendant and his counsel of the opportunity to ask for the said document.”

He pointed out that the witness complied with the court’s request to deliver the document.

Join Television Nigerian Whatsapp Now

Join Television Nigerian Facebook Now

Join Television Nigerian Twitter Now

Join Television Nigerian YouTUbe Now